Now you can do mobile banking without internet

The current cash crunch being faced by people due to demonetization of old notes has led them to explore other means of making their daily transactions. The government is also aggressively pushing digital methods for payments with a lofty ambition to make the economy primarily cashless. While for people with smartphones and internet connectivity, there is a myriad of options available, ranging from digital wallets, credit and debit cards, and of course, UPI; a significant part of the population using feature phones or those with poor connectivity do not have the luxury of these options. For them, there is now a method by which they can make transactions as quickly as checking their call balance, without the use of the internet.

How to transfer money?

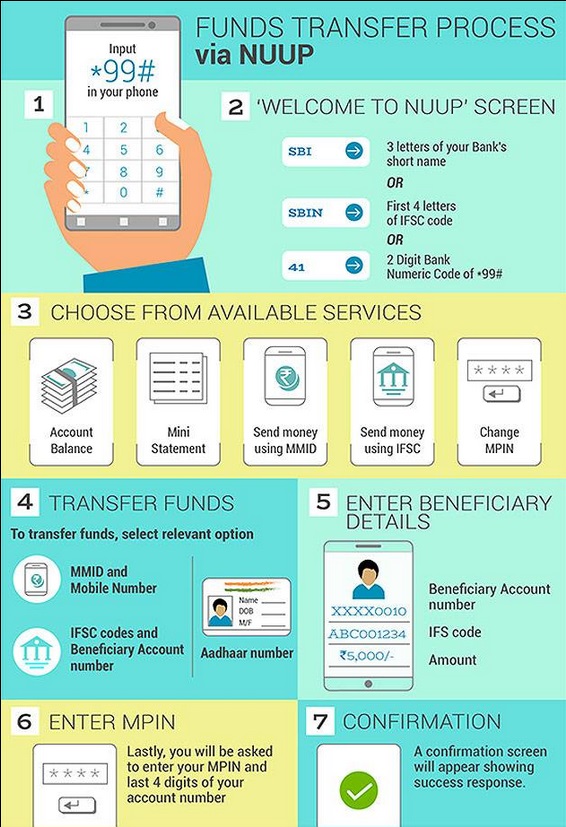

Let us see how one can transfer funds from their bank account to another account via USSD:

- To use USSD for fund transfer, a person should be registered for mobile banking with the respective bank. One can easily get registered for mobile banking by submitting a form at the nearby home branch of the bank.

- Next, to start a USSD session, type *99# and press call from the phone. *99# is the USSD code to start a banking session in English language. Codes are available for 11 regional languages as well.

- After this, you need to type 3 letters of your bank’s short name, or first 4 letters of IFSC code, or a 2-digit numeric code of the bank. The numeric codes and IFSC codes of major banks can be seen here .

- Next, choose from two available options: transfer using IFSC code and beneficiary account number, or, transfer using MMID code.

- Transfer using IFSC code is done by entering the beneficiary details like their account number and IFSC code of their bank branch, and then making the transfer.

- MMID (Mobile Money Identifier) is a code that is issued to every bank customer who is registered for mobile banking. It can also be generated through Net Banking or by visiting the bank’s ATM. Once you have the MMID of the beneficiary, enter it along with their mobile number, and complete the fund transfer.

- Once you have entered the recipient details (MMID or IFSC details), you will be prompted to enter your MPIN (mobile banking PIN) and last 4 digits of your bank account number. It will authorize the bank to transfer funds from your account and the transaction will be complete.

Charges and limit:

Earlier, each transaction used to be charged Rs. 1.50 by the telecom operator. Now, TRAI has reduced the charges to Rs. 0.50 in order to make this service more popular among people. These charges are unchanged even while on roaming. Up to Rs. 5000 can be transferred at one time using USSD.

Watch Video Here: